mississippi state income tax rate 2021

FY 2021 CDBG-DR State of Texas Upper. If filing a combined return both spouses workeach spouse can calculate their tax liability separately and add the results.

2021 State Corporate Tax Rates And Brackets Tax Foundation

Mississippi Income Tax Calculator 2021.

. Mississippi Income Tax Rate 2022 - 2023. Mississippi state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with MS tax rates of 0 4. Combined Filers - Filing and Payment Procedures.

Box 23050 Jackson MS 39225-3050. 0 on the first 3000 of taxable income. The 2022 state personal income tax.

The graduated income tax rate is. As you can see your income in Mississippi is taxed at different rates within the given tax brackets. 2020 Tax Returns Processed in 2021 by State with.

80-105 Resident Return. 3 on the next 1000 of taxable income. 80-107 IncomeWithholding Tax.

Box 23058 Jackson MS 39225-3058. Your average tax rate is 1198 and your marginal. 80-100 Individual Income Tax Instructions.

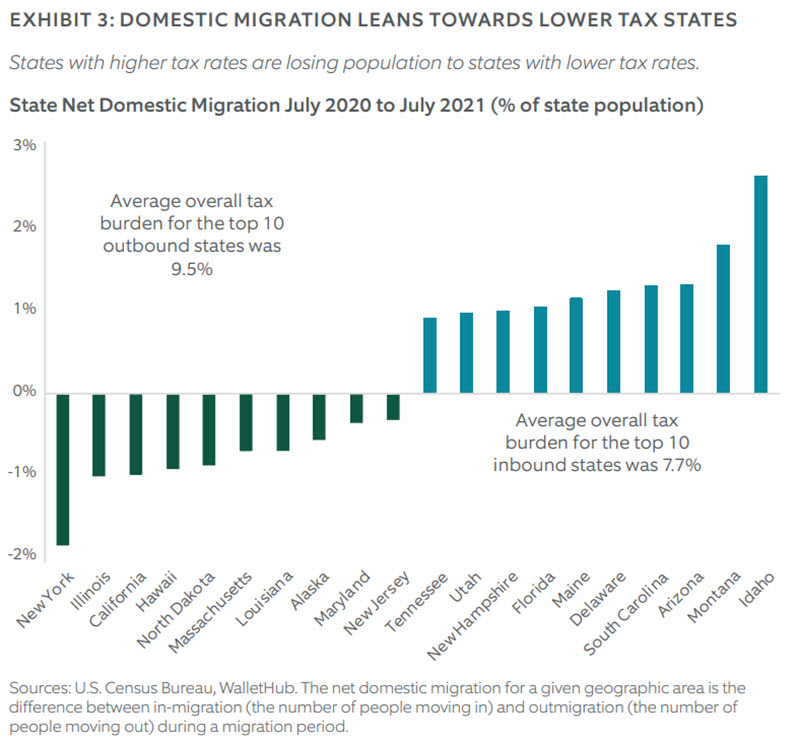

In Mississippi theres a tax rate of 3 on the first 4000 to 5000 of income for single or married filing taxes separately. Overall state tax rates range from 0 to more than 13 as of 2021. Maximum 2022 Taxable Earnings.

There are seven federal income tax rates in 2022. Mississippi Tax Brackets for Tax Year 2021. 76398 Highest Income Maryland 87063 Lowest Income Mississippi.

State Income Tax Arizona. There is no tax schedule for Mississippi income taxes. These rates are the same for individuals and businesses.

Eligible Charitable Organizations Information. Welcome to The Mississippi Department of Revenue. Any income over 10000 would be taxes at the.

California Hawaii New York New Jersey and Oregon have some of the highest state income tax rates in. 80-106 IndividualFiduciary Income Tax Voucher. If you are receiving a refund PO.

71-661 Installment Agreement. 5 on all taxable income over 10000. This calculator estimates the average tax rate as the state income tax liability divided by the total gross income.

Hurricane Katrina Information. The graduated income tax rate is. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472.

Income Tax Calculator 2021 Mississippi 141000. 0 on the first 4000 of taxable income. Because the income threshold for the top bracket is quite low.

While Mississippis state-level sales tax rate of 7 percent is the second highest such rate in the. Mississippi has a graduated tax rate. Supplemental Wage Bonus Rate.

Before the official 2022 Mississippi income tax rates are released provisional 2022 tax rates are based on Mississippis 2021 income tax brackets. Before the official 2022 Mississippi income tax rates are released provisional 2022 tax rates are based on Mississippis 2021 income tax brackets. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5.

The 2022 state personal income tax. The proposed legislation does so by gradually increasing the personal exemption. If youre married filing taxes jointly theres a tax rate of 3 from 4000.

Mailing Address Information. 3 on the next 2000 of. Mississippi has a graduated income tax rate and is computed as follows.

How do I compute the income tax due. The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi. Mississippis Individual Income Tax Rate Schedule Tax Year 2021 All Filers.

All other income tax returns P. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Unemployment Insurance Arizona Federal.

The Mississippi Tax Freedom Act aims to eliminate the individual income tax in a period as short as a decade. Of AZ Gross Taxable Wages. 4 on the next 5000 of taxable income.

Married taxpayers must make more than 16600 plus 1500 for each. FY 2021 CDBG Income Limits Effective June 1 2021. For single taxpayers your gross income must be more than 8300 plus 1500 for each dependent.

U S States Maintain Strong Financial Outlook Northern Trust

Mississippi Income Tax Rate And Ms Tax Brackets 2022 2023

Mississippi Tax Rate H R Block

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

How Do State And Local Individual Income Taxes Work Tax Policy Center

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

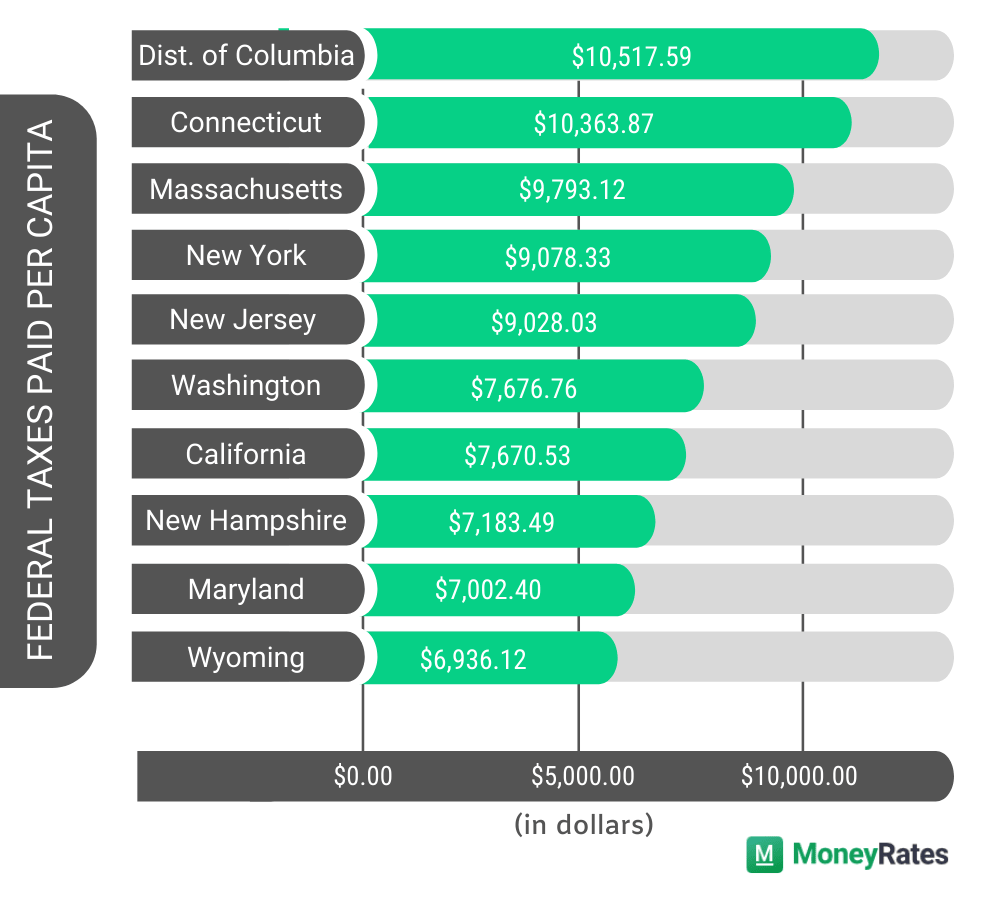

Which States Pay The Most Federal Taxes Moneyrates

Taxes On Unemployment Benefits A State By State Guide Kiplinger

Property Taxes By State Embrace Higher Property Taxes

Mississippi State Withholding Form 2021 Fill Out And Sign Printable Pdf Template Signnow

File Top State Marginal Tax Rates Jpg Wikimedia Commons

Are There Any States With No Property Tax In 2022 Free Investor Guide

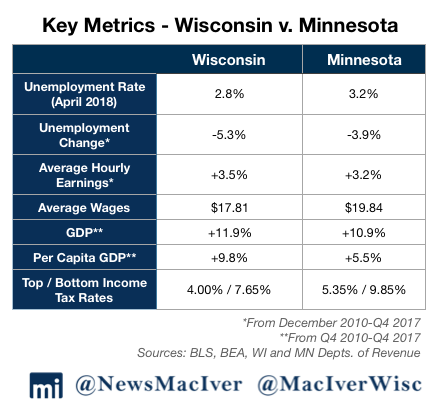

Data Wonk Comparing Wisconsin And Minnesota Urban Milwaukee

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Tax Withholding For Pensions And Social Security Sensible Money

Mississippi Tax Rate H R Block

Gov Reeves Signs 524 Million Tax Cut As Funding Woes Remain

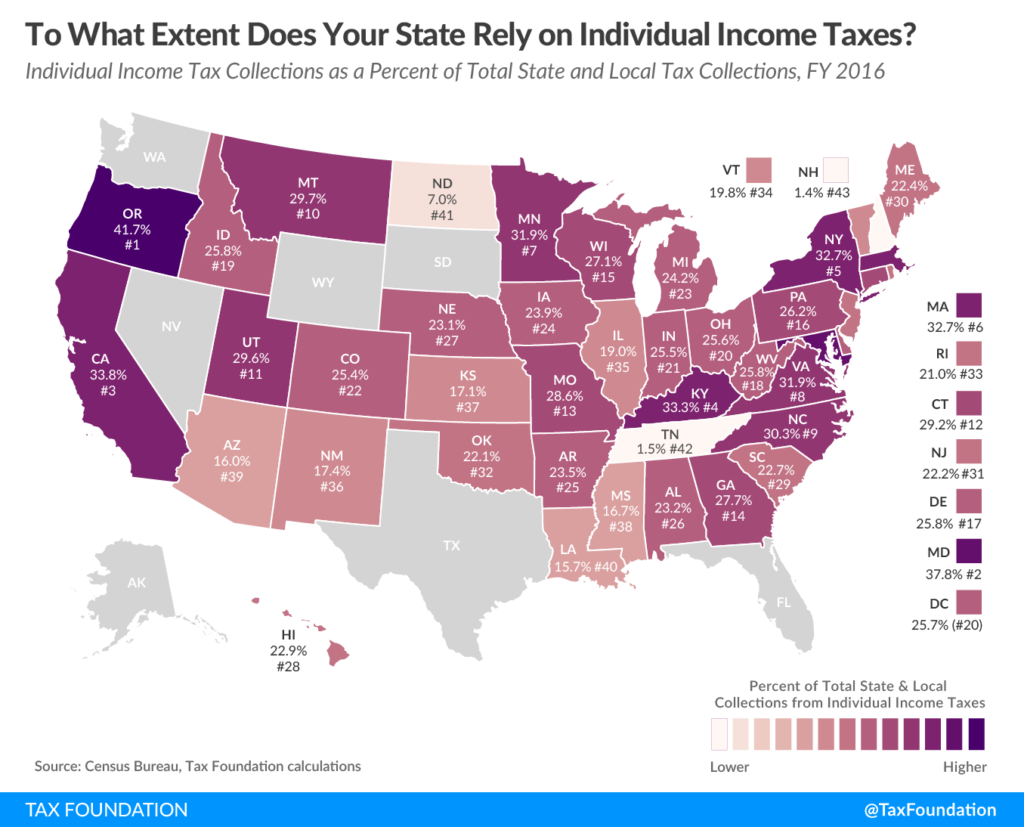

A Look At Mississippi S Reliance On Individual Income Taxes Mississippi Center For Public Policy